Ex-Fed Governor: QE 'An Untested, Incomplete Experiment'

From New Nom - Ex Feds Gov. critique of QE

Ex-Fed Governor: QE 'An Untested, Incomplete Experiment'

From New Nom - Ex Feds Gov. critique of QE

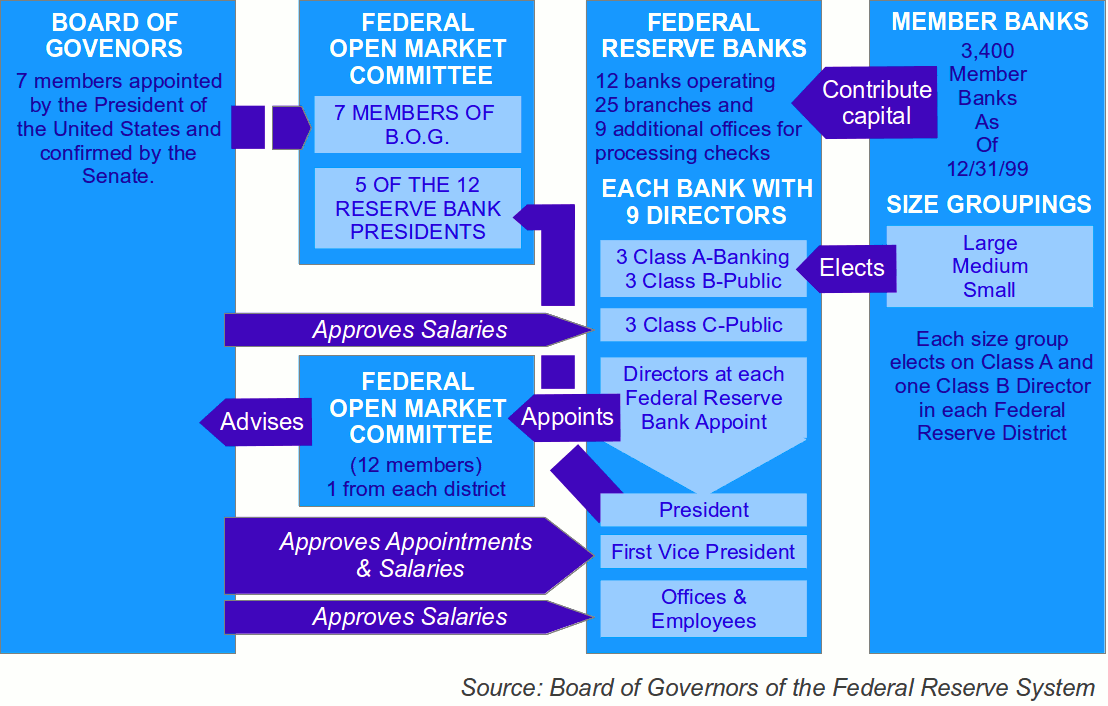

Former Fed Governor of Fed Kevin Warsh commented on the QE policy of the Federal Reserve. He writes for Wall St. Journal and lectures at the Stanford Business School.

The risk from QE he says, QE, is not hyperinflation, but that of financial stability.

Here are excerpts from the post:

"The most pronounced risk of QE is not an outbreak of hyperinflation. Rather, long periods of

free money

and subsidized credit are associated with significant capital

misallocation and malinvestment—which do not augur well for long-term

growth or financial stability."

Supporters of current Fed policy argue that QE offers broad support to

the economy. "Most [general observers] do not question the Fed's good

intentions, but its policies have

winners and losers, which should be acknowledged forthrightly," Warsh says.

The Fed's purchase of mortgage-backed securities helps existing

homeowners while hurting renters and prospective homeowners, he writes.

The Fed's interest-rate suppression has pushed investors into stocks,

Warsh notes.

"The immediate beneficiaries: well-to-do households and established

firms with larger balance sheets, larger risk appetites and access to

low-cost credit," he says.

"The benefits to workers and retirees with significant fixed obligations

are far more attenuated. The plodding improvement in the labor markets

offers little solace."

Many Fed watchers loudly applaud the central bank for its increased transparency in recent years. But Warsh has qualms.

"

Full disclosure of its

balance sheet and operations is essential to the Federal Reserve's

democratic legitimacy," he agrees. "But transparency in communications

about future policy is not a virtue unto itself."

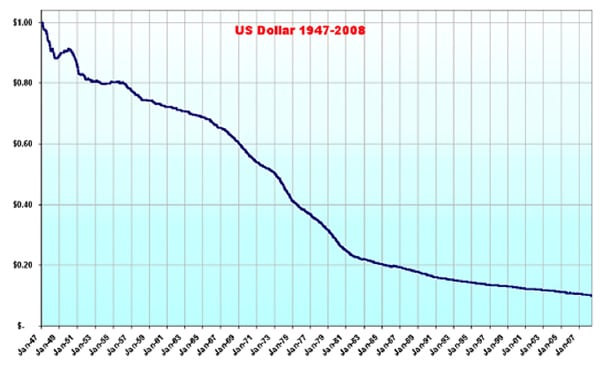

We need innovation but maybe the idea of providing liquidity to the economy through purchase of bank assets may be new and nice. But having assets means there is interest expense and there may be loss for the central bank to be shouldered by taxpayers.