Tuesday, November 19, 2013

jorge thought you might find this interesting. . .

jorge (jorge.saguinsin@gmail.com) came across this link and thought you would be interested in checking this out.

New Fed Rules May Hamper Mortgage Lending

New Fed Rules May Hamper Mortgage Lending

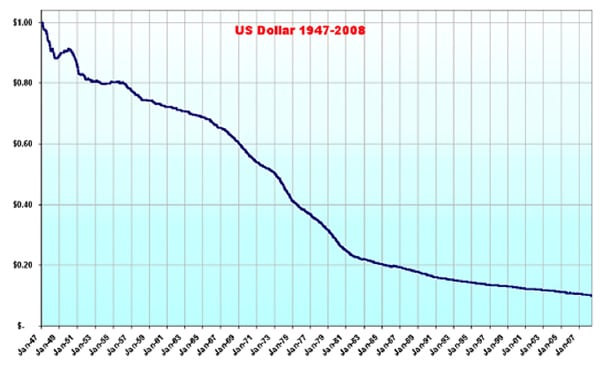

US influence and value of dollar both shrinking?

The World of Influence for the US Is Shrinking Along With Use of the Dollar

From CS monitor - how US suffers when US dollar value falls?

From Spiegel - Humiliation for US dollar; shrinking influence of the US Federal Reserve Bank

The US showed it is still the world's big brother:

1. In the PHL Supertyphoon disaster, it sent $20 million in aid and its battle group to help the PHL;

2. News has it that it is still the number one economy in the world, although it may grow only at 0.2% in 2013;

3. It has shown leadership in the Iran nuclear worries, albeit, without the objection of Arab countries and from the homefront.

As the value of the dollar shrinks because of QE and too much printing of the money, triple deficit, debt limit problems, loss of jobs, its influence over the world is diminished. Many of settlements in HK are done via the Chinese red bucks (the yuan)

Is US really on the way down?

How pitiful, for the world's greatest superpower, the Almighty dollar, the land of the brave and of he free?

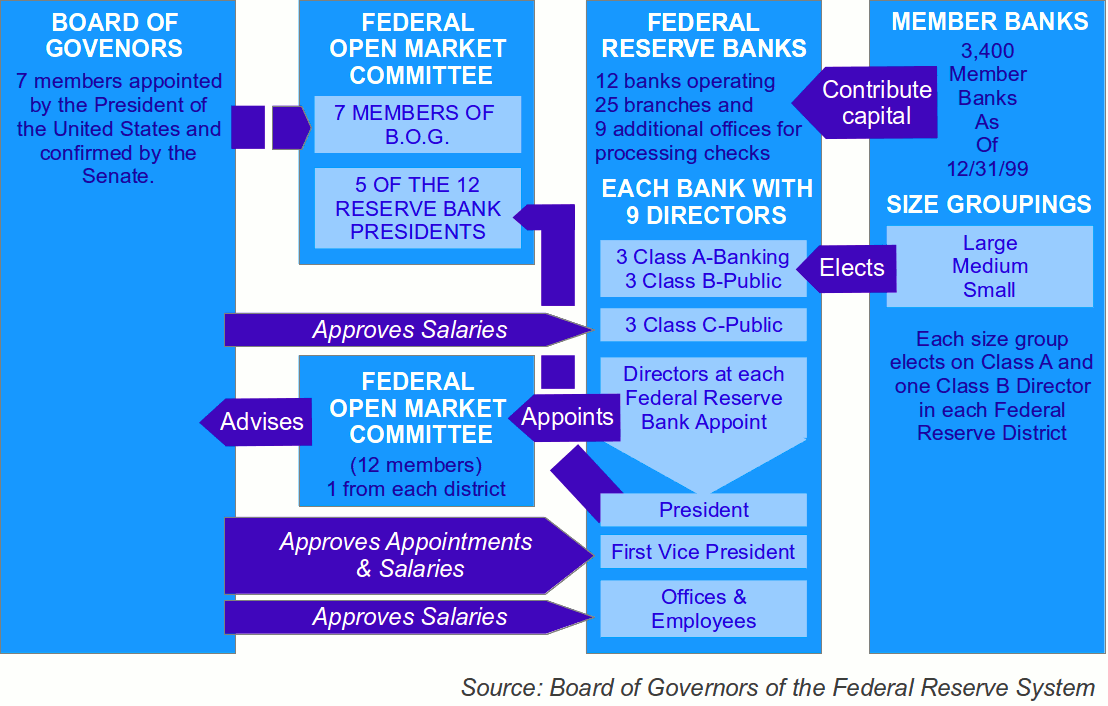

Fed Reserve Bank needs to be audited too

Fed Needs to Be Audited Regularly

I heard Mr. Meliton Salazar talk about integrity and ethical behavior in public offices last week. He said the Rotarian 4 way test should be a litmus paper behavior in govt offices. He said that while in Monetary Board, CB required banks to have audit committee in their boards. However, he noted that there was no audit dept nor audit committee in CBP (still CBP during his time)

In the US time has come to audit the US Central Bank. A piece of legislation was passed and approved by US Congress, The US Federal Reserve Bank Transparency Act of 2009, but has stalled in US Senate for the past 3 years.

The first audit of Fed Reserve Bank by GOA was made in 2009 as compliance to the Dodd- Frank Wall St Reform and Consumer Protection Act

In 2011, Levi Institute of Economics has calculated the total liquidity provided by Feds to the bank to be in the order to of $29 trillion. and that includes loans, asset purchases, and guarantees.

Another showdown; Sen Rand Paul to block Obama nominee to Fed, unless Harry Reid allows audit the Fed vote

QE is an untested experiment - Ex Fed Governor Kevin Warsh

Ex-Fed Governor: QE 'An Untested, Incomplete Experiment'

From New Nom - Ex Feds Gov. critique of QE

Former Fed Governor of Fed Kevin Warsh commented on the QE policy of the Federal Reserve. He writes for Wall St. Journal and lectures at the Stanford Business School.

The risk from QE he says, QE, is not hyperinflation, but that of financial stability.

Here are excerpts from the post:

"The most pronounced risk of QE is not an outbreak of hyperinflation. Rather, long periods of free money and subsidized credit are associated with significant capital misallocation and malinvestment—which do not augur well for long-term growth or financial stability."

Supporters of current Fed policy argue that QE offers broad support to the economy. "Most [general observers] do not question the Fed's good intentions, but its policies have winners and losers, which should be acknowledged forthrightly," Warsh says.

The Fed's purchase of mortgage-backed securities helps existing homeowners while hurting renters and prospective homeowners, he writes. The Fed's interest-rate suppression has pushed investors into stocks, Warsh notes.

"The immediate beneficiaries: well-to-do households and established firms with larger balance sheets, larger risk appetites and access to low-cost credit," he says.

"The benefits to workers and retirees with significant fixed obligations are far more attenuated. The plodding improvement in the labor markets offers little solace."

Many Fed watchers loudly applaud the central bank for its increased transparency in recent years. But Warsh has qualms.

"Full disclosure of its balance sheet and operations is essential to the Federal Reserve's democratic legitimacy," he agrees. "But transparency in communications about future policy is not a virtue unto itself."

We need innovation but maybe the idea of providing liquidity to the economy through purchase of bank assets may be new and nice. But having assets means there is interest expense and there may be loss for the central bank to be shouldered by taxpayers.

China stocking up on Gold as Prices Drop

China Seen by Klapwijk Boosting Gold Reserves as Prices Drop

From Global Research - China and Russia acquiring more gold, dumping dollars

From Gold Seek - Central Bank Gold Reserves growing

China may have increased its gold bullion reserves by as much as 300 metric tons during the first half of the year according to Klapwijk of Precious Metals Insights, to diversify its currency reserves, the biggest in the world. In 2009, China announced its gold bullion reserves to be over l,000 metric tons.

Such purchases may have limited the gold price drops which was at $1,319 per ounce, and gold entered the bear market since April in and fell 23% in second quarter, the steepest since 1920.

Gold is but mere 1.3 % of the total currency reserves of China which stands at $3.66 trillion; US has 73% and has the biggest gold reserves at 8,1335 tons. Germany has 3390 tons

Subscribe to:

Posts (Atom)